Shopify Payments Alternatives

Looking for alternatives to Shopify Payments? Why would anyone replace Shopify’s outstanding, in-house, and perfectly integrated payment gateway with a third-party provider? Well, for smaller merchants, this question rarely comes up. Shopify Payments offers fair pricing and works reliably. Combined with the relatively high transaction fee Shopify charges for using external payment providers (especially on lower-tier plans), smaller merchants are unlikely to save money by switching.

However, there are cases where Shopify simply won’t allow a store to use its native gateway. This can happen because of the types of products being sold, such as nicotine or nicotine replacement products, CBD, adult products, or alcohol. In many of these cases, Shopify Pay will simply not approve the business. Additionally, if a merchant is based in certain countries, like Estonia (popular for its e-residency program) or Switzerland – Shopify Payments is often not an option. In these situations, finding an alternative to Shopify Pay becomes a necessity rather than a choice.

General drawbacks of Shopify Payments

As sales volume grows, Shopify Payments can become slightly more expensive compared to competing providers. Stores using the “Advanced” Shopify plan (Shopify Advanced, typically worthwhile at around €50,000 in monthly revenue) should at least take the time to compare alternatives. We’ve also heard from several clients that Klarna’s acceptance rates through Shopify Payments aren’t always ideal. By integrating Klarna directly as an external payment provider, merchants pay Shopify’s additional transaction fee but often see significantly higher approval rates. For stores selling high-ticket products where Klarna Pay Later (invoice purchase) is popular, that improvement can easily offset the extra fee through increased conversions.

Costs: Alternative providers vs. Shopify Payments

Note: The following examples reference Mollie, Boodil, Stripe, and Skrill. We haven’t yet worked with Stripe or Skrill in direct connection with Shopify, so their inclusion here is not a blanket endorsement. However, we’ve successfully implemented Mollie (based in the Netherlands) and Boodil (based in the United Kingdom) in Shopify projects and can recommend both.

Boodil recently stood out to us as an up-and-coming provider offering a technically solid and highly flexible solution. Particularly positive features were the easy-to-use payment form and the removable branding – so that only the merchant name appears on the payment form and credit card statement – as well as the simple, linear checkout process with support for Apple Pay and Google Pay.

Boodil also specializes in payment processing for industries where Shopify Payments is unavailable, such as CBD or vape products in German-speaking countries (Germany + Austria). (This specialization explains why Boodil’s prices are always quoted individually per store and not listed on their website. You can, however, .)

We support you in every aspect of your Shopify setup

Call us at +49 (0) 30 – 40 36 38 90 or

Example:

Let’s take a store owner generating €50,000 in monthly revenue through credit card payments using Shopify Advanced. (For simplicity, we’ll focus on VISA transactions, as fees can vary slightly between providers.)

On Shopify’s Advanced plan, the rate is 1.8% + €0.25 per transaction. A quick Google search shows that Adyen offers 0.90%–1.10% + €0.10 per transaction, Skrill: 1.2% + €0.29, Stripe: 1.4% + €0.25, and Mollie: 1.8% + €0.25. And that’s without negotiating custom rates for our example transaction volume of €50,000 per month. In other words, we’d already be paying slightly less, or about the same as, Shopify Payments. With individualized pricing, the savings could easily be substantial.

But keep in mind when using external providers:

- All third-party providers incur Shopify’s 0.5% external payment provider fee. (For Shopify Plus, the transaction fee drops to just 0.15%.)

- You should also review additional costs such as chargebacks, payout fees, and currency conversion charges before switching.

- Payout frequency varies by provider. For instance, Mollie issues payouts twice a week, helpful for merchants looking to improve cash flow.

External “gateway” payment providers

External payment providers generally fall into two categories:

- Standard: A provider that directly processes payments through one or more payment methods (PayPal, Skrill, Amazon Pay, etc.).

- Gateway: A provider acting as a bridge between multiple payment options:

It’s worth comparing options carefully, as there are scenarios where gateway providers can turn out to be more cost-effective than standard ones.

Recommendations for external payment providers

We generally recommend taking a close look at established European providers, especially Klarna’s direct integration, Mollie from the Netherlands, and Boodil from the UK. The payment provider landscape is highly competitive, and established merchants with solid monthly revenue are in a strong position. Working directly with providers allows you to negotiate custom rates, unlocking significant savings potential.

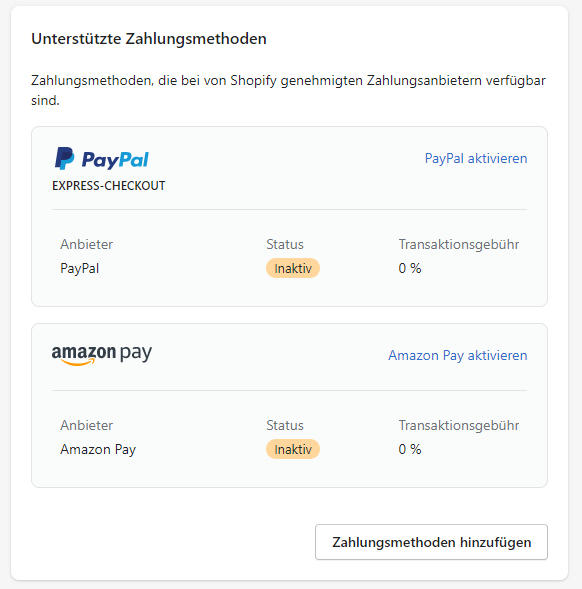

Payment via PayPal

For completeness, we should also mention PayPal and Amazon Pay. Shopify ended its partnership with Amazon Pay in 2024, so payments through Amazon Pay are currently not possible. While calling PayPal a true Shopify Payments alternative would be an exaggeration, it’s still highly recommended and can be used alongside Shopify Payments.

PayPal can be added both as an express checkout button and as a payment method on the checkout page (right after Shopify Payments). All you need is a PayPal business account, which you can easily connect via Admin > Settings > Payments in just a few clicks.

Note: If Shopify Payments is also active, Shopify waives its transaction fee for both PayPal and Amazon Pay.

Manual payment methods in Shopify

We should also mention Shopify’s manual payment options, such as bank transfer (“Bank Deposit”). While not a real alternative to Shopify Payments, many stores still offer it. However, the lack of automation can make it impractical for larger stores, often costing more time than it saves in fees. (A possible solution is Billbee, though this depends on your backend processes.)